Nearly 200 professionals from 80 organizations—including operating and supplying companies, universities, and government agencies—participated in the webinar on “Fair Market Valuation in Upstream,” held on July 23 as part of the best practices exchange series by the Arpel Exploration and Production Committee.

The presentation was delivered by Nathan Baumgartner, Reservoir Engineer at DeGolyer and MacNaughton. The session was moderated by Raúl Belkenoff from YPF and Pablo Amoedo from Arpel.

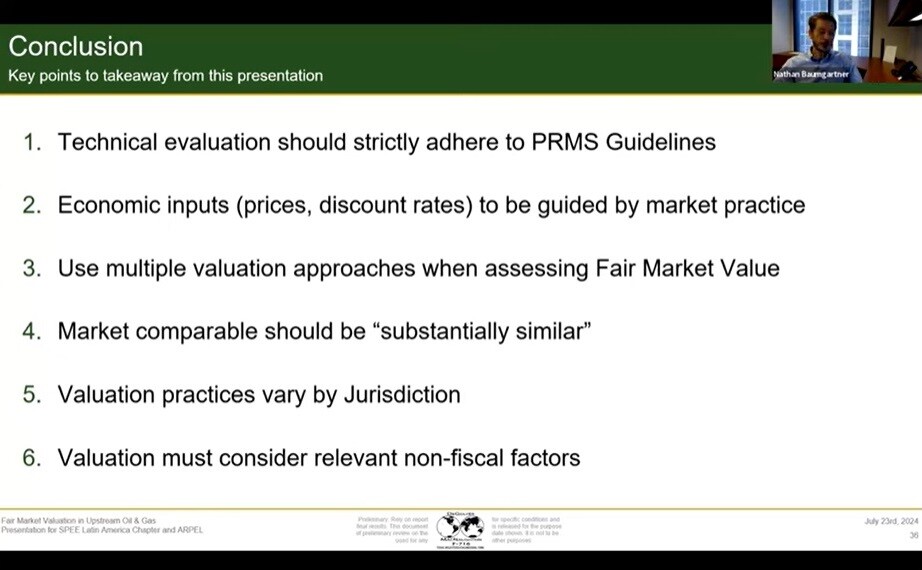

During the virtual activity, common valuation methodologies, U.S. versus international valuation practices, and the challenges that affect the estimation of fair market value were addressed as main topics.

The presentation aimed to assist professionals with practical knowledge on the fair market valuation process, supplemented with illustrative examples.

According to Baumgartner, the fair market valuation of an upstream asset involves three stages: Technical Evaluation, Economic Evaluation, and Fair Market Valuation.

At the start of his presentation, Baumgartner explained that fair market value is the price a buyer is willing to pay and a seller is willing to accept when a property is exposed to the market. This value is determined through a process of technical and economic evaluation.

Baumgartner highlighted that fiscal terms significantly influence project valuations, affecting cash flows and economic evaluation. “More generous fiscal terms result in higher valuations,” he said.

To watch the full webinar, visit the following link: https://www.youtube.com/watch?v=K18D3ztHLsk