Oil has been decisive in the political configuration of the 20th century, however, important changes are on the horizon where energy is generated locally, mainly from renewable energy, and consumed in the form of electricity. The geopolitics of energy are very likely to be affected in the coming decades.

The presentation on of Carlos Pascual, Senior VP of Global Energy and International Affairs for S&P Global, at 2024 Arpel Naturgas Week was enlightening. Lecturing about how geopolitical tensions directly affect the energy sector, he said: “I have never lived such a challenging period in international politics”.

The risk of miscalculation and deepening conflict on every major geopolitical issue will increase through 2024 and the US elections. Can a polarized US stay globally engaged? Can President’s Xi and Biden define a course for cooperation? What is the future of Gaza and the Palestinian cause? With all these questions on the table and a very difficult prospect for diplomatic settlement between Ukraine and Russia, the Latin American and Caribbean Region seems to be ignored while seeking a just energy transition. Despite the Middle East conflict, supply growth outside OPEC+ met world oil demand growth in 2023 and, until now, in 2024.

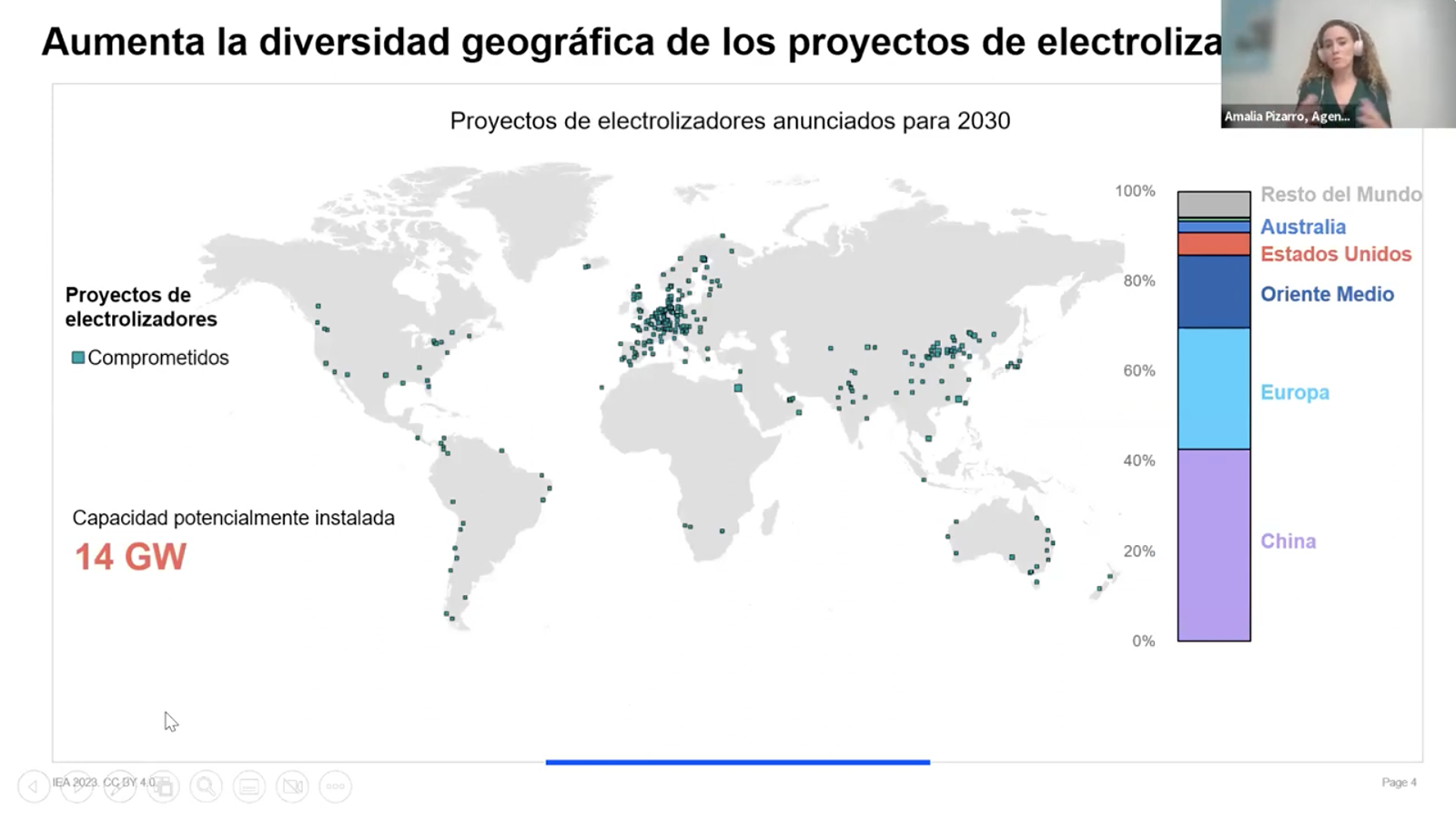

One point is clear: electricity demand must boom in all scenarios in every sector and accelerating energy transition will boost the demand for key minerals; copper, cobalt, nickel, lithium, graphite and rare earths. And it is worthwhile mentioning that China dominates key metals processing (over 70% worldwide in several of them). This may jeopardize the benefits of global supply chains.

As an example, between 1990 and 2012, only 3% of the global energy matrix driven by fossils was changed and the current goal is to achieve a 60% change by 2050, i.e., in just 26 years. So, in Carlos Pascual opinion, the aim to decarbonize the economy will be hard to achieve.

According to the former diplomat, in all these conflicts, “the capacity to reach agreements is very limited”. And this leads to geopolitical impact on the price of oil. “Immersed in international politics, several changes are taking place in the global energy matrix.”, he said.

Geopolitical shocks and price volatility are inescapable. Some factors to be monitored in the impact of geopolitics in the oil and gas industry -in the context of energy transitions- include the US/China competition for economic leadership and national security, understanding that technology -more than diplomacy- will close gaps with emission targets, and the fact that private sector will most likely carry the burden of innovation and finance. A message of hope for Latin America and the Caribbean: the region’s resources can reposition its ties to global supply chains.

Carlos Pascual highlighted that several changes are taking place in the global energy matrix intertwined with international politics. “Until we change our energy systems, oil supply will be necessary to counterbalance geopolitical shocks”, he concluded.

See the full conference: https://www.youtube.com/watch?v=UU_noKgaT7M&t=1686s